#098: MY STUDENT'S STRATEGIES (CASE STUDY #41)

- Jun 1, 2018

- 3 min read

You already know that when it comes to breakout strategies, my favorite markets are emini futures like TF or EMD as it is quite easy to find a breakout strategy for these. But besides this market group, there are a couple of other markets that are quite good for breakout strategies as well. One of them is the soybean market. We’ve already had a couple of strategies for this one and, today, I will present you with another one.

It is using just one timeframe, daily, trading both long and short, and in 10.5 years it has generated almost $100,000 profit, with an $8,270 drawdown. That is a bit more than what we usually have, but this time it is a swing strategy, it doesn’t have an exit at the end of the day.

Here is the basic information:

Market: Soybean (S)

Main time frame (data1): Daily

Secondary time frame (data2): N/A

Time template: 8:30am - 1:20pm

Profit factor: 1.66

Win %: 50.91%

Avg.trade: 363.27 USD

Exit: Stop-loss or Profit Target (avg. winning trade +1,789.73 USD)

Stop-loss: Variable (avg. losing trade -1,116.02 USD)

All of these numbers already contain commissions ($2.5) and slippage ($25) per trade - unlike most of the other strategies I’ve shared with you.

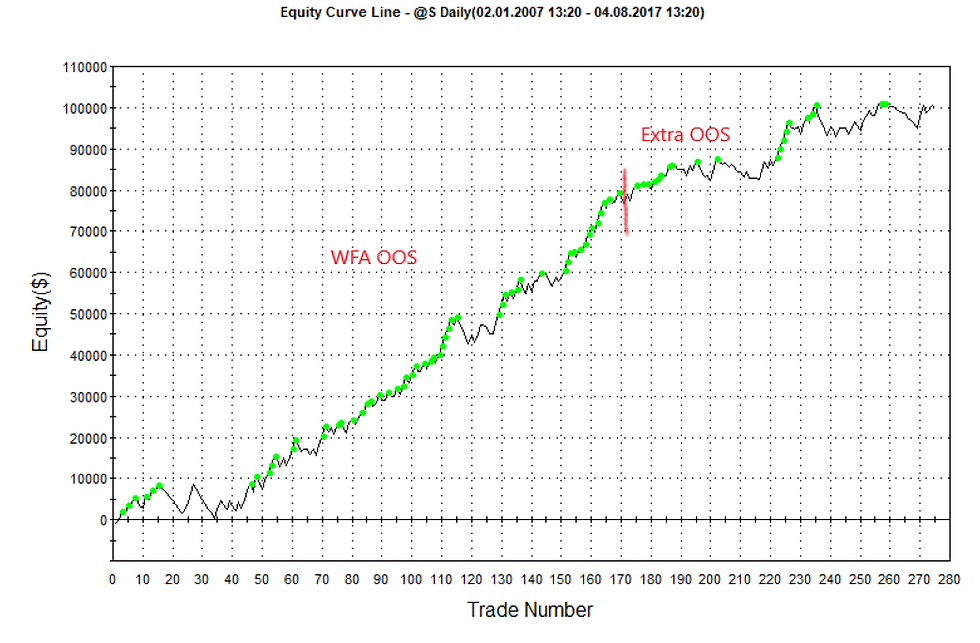

This strategy was developed with data from 2007 to 2014 and the part from 1/1/2015 onwards is considered to be ‘Extra OOS’ - an additional unseen data that hasn’t been used for the strategy development and was just used for an additional OOS interval to confirm the robustness of this strategy:

The walk forward analysis OOS is the first around 170 trades, and the rest is the additional OOS period. So far, this result looks really promising. And the Extra OOS can prepare us for the real trading even better; it tells us what we can expect once we go live.

The total number of trades seems to be quite low, it is just 275 in about 10.5 years, that is about 26 trades per year on average, but this is not an intraday strategy. The average time this strategy keeps the position open is 5.6 days. That means that sometimes the position stays open over the weekend as well.

But let’s get back to the chart - in the beginning, we can see the biggest drawdowns, reaching over $8,000, then again one more at about trade #120, and then we can see a couple more in the Extra OOS period. Sometimes it can take 20-30 trades to recover, which is a year in this case, but then there are some periods in which the strategy can earn close to $20,000 in a year.

Let’s take a look at how the performance report looks:

Here, you can see that even though the strategy only does 26 trades per year, you are in the market over 50% of the time (51.94%). The intraday strategies can be around 1-2% of the time in the market.

Long trades perform slightly better - they have a better profit factor, profitable percentage, and average net profit as well. The number of high trades is about 50% more than the number of short trades, and when we put all these small differences together, we can see that all long, trades made over twice as much profit than the short trades.

So far, it’s looking good. Let’s take a look at other markets as well. Let’s start with soybean meal, also with a daily timeframe:

The number of trades is even lower, the drawdown is getting close to $15,000, so not really an ideal equity curve, but at least we can see a rising tendency, which is really positive.

What about other grains, like corn?

Despite not having a good start, the strategy started rising later on and, after hitting the bottom, we can see a positive rising tendency.

Let’s try something different now - how about one of the index markets - Russell 2000 (TF):

This is a nice surprise. The number of trades is a bit low, just about 100, but we can see that the strategy keeps making new equity highs. The drawdowns exceed $5,000, but don’t forget that this strategy was created for a completely different market.

We don’t have many swing strategies here - most traders start with intraday as the drawdowns are usually lower and you don’t need that much capital for those. But once you have a stable intraday portfolio with a couple of strategies running, it is good to take a look around and also start building some swing strategies as well. It is always good to have a couple of them in your portfolio.

Click here to learn how to build similar (and even better) strategies.

Happy Trading,

Tomas

Click here to read more success stories.

Comments